CRISIL has upgraded its ratings on the long-term debt instruments, and long-term bank facilities of Marico to 'AA+/Stable' from 'AA/Positive', and has reaffirmed its rating on the short-term debt programme and short-term bank facilities at 'A1+'.

CRISIL has upgraded its ratings on the long-term debt instruments, and long-term bank facilities of Marico to 'AA+/Stable' from 'AA/Positive', and has reaffirmed its rating on the short-term debt programme and short-term bank facilities at 'A1+'.

The rating upgrade reflects CRISIL's expectation of improvement in Marico's business risk profile over the medium term driven by increasing revenue diversity and dominant market position in branded coconut oil, value added hair oil, and premium refined edible oil segments.

The rating upgrade reflects CRISIL's expectation of improvement in Marico's business risk profile over the medium term driven by increasing revenue diversity and dominant market position in branded coconut oil, value added hair oil, and premium refined edible oil segments.

CRISIL believes that Marico's business risk profile will benefit from increasing diversity in revenue profile and Marico's strong market position over the medium term. The outlook may be revised to 'Positive' if Marico further diversifies its revenue and accrual base. Conversely, the outlook may be revised to 'Negative' in case the company contracts more-than-expected debt to fund any significant acquisition, or if the margins or revenue growth is lower-than-expected, leading to weakening of its financial risk profile.

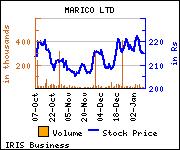

Shares of the company declined Rs 0.9, or 0.42%, to settle at Rs 214.50. The total volume of shares traded was 2,420 at the BSE (Tuesday).